Regional cooperation on electricity trade

While expanding solar and wind will be an important factor in helping Vietnam to reduce its coal consumption and meet its COP26 commitments, increasing power imports from neighbors is another step in this process. The April 2022 version of Vietnam’s Power Development Plan 8 (PDP 8) anticipates electricity imports rising from just 572 MW in 2020 to around 4,000 MW by 2025.

Photo: A solar project invested by Trung Nam Group © Trung Nam Group

Vietnam’s future power imports will largely come from Lao PDR and possibly Cambodia. However, the way in which Vietnam engages in electricity trade with its neighbors will directly influence the development of power generation projects in those countries. Much of the power that Vietnam imports from Lao PDR could come from dams that do significant harm to Vietnam.

Conversely, if the three countries cooperate on energy planning and investment, they can meet regional power needs, diversify the energy mix, and maintain the river connectivity that is essential for fisheries and sediment delivery to the Mekong Delta.

ASEAN countries have discussed electricity trade for over 30 years, and a more interconnected grid would bring clear benefits. In 2012, the ADB estimated that electricity trade could save up to $200 billion in energy investments across the Greater Mekong Subregion. An IEA study showed that improved connectivity would allow ASEAN to better integrate hydropower, solar, and wind because it allows for better planning around weather. These benefits are evident in regional power grids in the US, Central America, EU, and Southern Africa.

Historically, Vietnam has kept imports low because of concerns over energy security. Although the amount of imported electricity has grown over time, its contribution peaked in 2010 at 5.6% of total power supply. Planned power imports have often not materialized: Vietnam’s PDP 7 expected imported power to make up 3.1% of total power supply by 2020, but only 1.3% of Vietnam’s electricity was imported that year. The revised PDP 7 in 2016 anticipated importing about 1,500 MW by 2030, just 1.2% of projected power supply.

While most of Vietnam’s electricity imports have come from China, future additional imports will mostly come from Lao PDR. This reflects concerns over dependence on China as well as Lao PDR’s aspiration of becoming the “Battery of Southeast Asia”. Lao PDR has signed MOUs with Thailand, Cambodia, and Vietnam to export more than 18,000 MW through 2030, at least 5,000 MW of which is intended for Vietnam.

Infographic: https://datawrapper.dwcdn.net/HSeMR/2/

Lao PDR has limited domestic financial resources and external funders determine which projects are built. As a result, decisions are typically made on a project-by-project basis in the absence of any strategic power plan to optimize trade-offs between energy, water, and fisheries. While Thailand and Cambodia have identified specific projects in Lao PDR from which to import electricity, Vietnam has kept its options open.

Lao PDR has more than 7,600 MW of projects under consideration in the Sekong river basin close to Vietnam. While Cambodia’s power purchases include coal and hydropower, Vietnam’s are likely to be more varied: the 2021 draft of Vietnam’s PDP 8 includes several projects in Lao PDR. These include wind and solar projects, including the Monsoon Wind Farm in southern Lao PDR for which Vietnam has signed a power purchase agreement. The list also includes 1,667 MW of hydropower from both mainstream and tributary Sekong dams. Damming the Sekong mainstream and cutting off a vital fish migration route would have a significant impact on regional fish productivity.

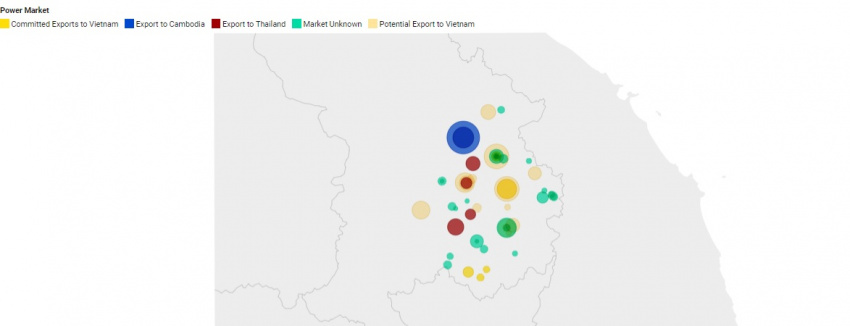

Energy Projects in 3S Basin by Export Market:

Photo: Energy development in 3S by market © the Stimson Center

Photo: Energy development in 3S by market © the Stimson Center

Vietnam, Cambodia, and Thailand’s decisions on which projects to buy from in southern Lao PDR will determine whether the Sekong remains connected to the Mekong and fish can continue to migrate up and down the river. Vietnam faces an immediate decision on whether or not to continue to participate in the Sekong A dam project close to the border with Cambodia.

Cambodia, Lao PDR, and Vietnam can move beyond bilateral power trade and start to coordinate energy generation and transmission regionally. The renewable energy transition, which is playing out with solar and wind in Vietnam, is an opportunity to adjust the regional power mix to be more resilient in the face of climate change and drought.

Expanding the geographic scope of renewable power would have significant benefits for Vietnam: its grid suffers from overconcentration of solar and wind in a few provinces, which causes large swings in power when the sun shines or the wind blows. Importing power from Lao PDR would reduce weather-related risk. Solar also balances the seasonal power generation of run-of-river hydropower, which dips during the dry season.

Our team’s 2020 study on energy options in the 3S river basins identified the following four scenarios all of which produce similar amount of power:

Associated scenario images from 3S Basin Energy Profile Study: see study

- Full Buildout, in which policy-makers pursue a business-as-usual approach that draws on the current inventory of hydropower, coal, solar, and wind projects. This would result in the construction of many or most of the power projects in the basin, including dams on the Sekong mainstream. This scenario assumes no coordination beyond bilateral power purchases, which could lead to significantly increased carbon emissions and river fragmentation.

- Coal-Heavy, in which Lao PDR builds 2,400 MW of coal for sale to Cambodia but Sekong mainstream dams do not move ahead. This scenario is increasingly unlikely as coal is now off-limits to most international funders, including China, which was previously a big funder. The price of coal has risen 5-fold since 2019 when Cambodia agreed to purchase coal electricity from Lao PDR, raising questions about whether coal is still competitive.

- Successful Renewable Energy Transition, in which the three countries pursue uncoordinated investments in renewable energy much like Vietnam has done in recent years. While some solar and wind projects might outcompete hydropower, decisions are made on a project by project basis. This scenario anticipates the successful transition to renewable energy through 2030 but includes high-risk dam projects like the Sekong A that could severely reduce river connectivity and fisheries.

- Finally, the three countries could coordinate energy planning and investment to optimize benefits. This could take the form of a 3S Clean Energy Zone in which the countries agree to remove hydropower dams with significant negative impacts from consideration and replace them with wind and solar, particularly floating solar, and/or low-risk dams on the Sekong’s tributaries.

If Cambodia, Lao PDR, and Vietnam coordinate energy planning and investment in ways that prioritize solar and wind, minimize coal, and eliminate high-risk hydropower projects, they can achieve this transition faster and cheaper that if they try and seek energy security separately.

This is the final of six web stories produced by the Stimson Center and IUCN under the Swiss Agency for Development and Cooperation BRIDGE (Building River Dialogue and Governance), a global hydro-diplomacy project that IUCN is facilitating in 15 transboundary river basins, including the Mekong. For the other five webstories, please see:

#1: Vietnam’s COP26 commitments: a moment of truth

#2: The Sekong A dam in Lao PDR and the Mekong Delta: a moment of decision for Viet Nam

#3: Unlocking international finance for Vietnam’s renewable energy transition

#4: Opportunities and challenges in expanding wind in Vietnam’s electricity mix

#5: Grid integration of renewables